All Categories

Featured

Table of Contents

For many people, the biggest issue with the unlimited financial idea is that first hit to early liquidity brought on by the expenses. This con of boundless banking can be decreased significantly with proper policy style, the initial years will certainly always be the worst years with any Whole Life plan.

That stated, there are particular infinite financial life insurance policy plans made primarily for high early cash worth (HECV) of over 90% in the initial year. However, the lasting efficiency will certainly often substantially delay the best-performing Infinite Banking life insurance policy plans. Having access to that extra four figures in the first few years may come with the cost of 6-figures down the road.

You actually obtain some substantial long-lasting advantages that help you recoup these very early costs and afterwards some. We find that this prevented very early liquidity issue with boundless banking is more mental than anything else when extensively discovered. If they absolutely required every cent of the money missing from their unlimited banking life insurance coverage plan in the initial couple of years.

Tag: infinite banking idea In this episode, I talk regarding finances with Mary Jo Irmen who instructs the Infinite Banking Principle. With the rise of TikTok as an information-sharing system, monetary advice and techniques have found a novel method of dispersing. One such approach that has actually been making the rounds is the boundless banking principle, or IBC for short, amassing endorsements from celebrities like rap artist Waka Flocka Fire.

Within these policies, the cash money value grows based on a price set by the insurance company. Once a significant money value gathers, insurance policy holders can acquire a money value lending. These lendings vary from traditional ones, with life insurance coverage working as security, meaning one might lose their coverage if borrowing exceedingly without ample cash money value to support the insurance policy costs.

And while the appeal of these plans is apparent, there are natural restrictions and risks, requiring attentive cash value monitoring. The approach's legitimacy isn't black and white. For high-net-worth individuals or service owners, specifically those using strategies like company-owned life insurance policy (COLI), the benefits of tax breaks and substance growth can be appealing.

Cash Flow Whole Life Insurance

The allure of unlimited banking doesn't negate its difficulties: Cost: The foundational demand, an irreversible life insurance policy policy, is costlier than its term equivalents. Qualification: Not everybody certifies for entire life insurance due to strenuous underwriting processes that can omit those with particular health or way of life conditions. Intricacy and danger: The elaborate nature of IBC, paired with its risks, might hinder numerous, particularly when easier and less high-risk choices are readily available.

Designating around 10% of your month-to-month earnings to the plan is just not possible for most individuals. Part of what you check out below is merely a reiteration of what has actually already been said above.

Prior to you obtain on your own right into a circumstance you're not prepared for, recognize the adhering to initially: Although the concept is generally marketed as such, you're not really taking a lending from on your own. If that held true, you would not have to settle it. Rather, you're obtaining from the insurance firm and have to repay it with rate of interest.

Some social media messages advise making use of cash money worth from whole life insurance to pay down credit score card financial obligation. When you pay back the finance, a part of that rate of interest goes to the insurance policy business.

For the first numerous years, you'll be paying off the commission. This makes it exceptionally difficult for your plan to build up value during this time. Unless you can manage to pay a few to several hundred bucks for the next years or more, IBC won't work for you.

Whole Life Concept Model

If you need life insurance coverage, here are some important pointers to take into consideration: Take into consideration term life insurance. Make certain to go shopping about for the finest price.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Font Name "Montserrat".

Infinite Credit Loan

As a CPA concentrating on actual estate investing, I've combed shoulders with the "Infinite Banking Principle" (IBC) extra times than I can count. I have actually even spoken with specialists on the subject. The major draw, apart from the obvious life insurance policy advantages, was always the concept of developing up cash money value within an irreversible life insurance coverage policy and borrowing versus it.

Sure, that makes feeling. But honestly, I always assumed that cash would be better spent straight on financial investments instead of channeling it via a life insurance plan Up until I discovered exactly how IBC might be integrated with an Irrevocable Life Insurance Count On (ILIT) to create generational wide range. Let's start with the essentials.

Infinite Family Banking

When you borrow versus your plan's money value, there's no set settlement schedule, providing you the liberty to manage the loan on your terms. At the same time, the cash money value remains to grow based on the policy's guarantees and rewards. This configuration permits you to gain access to liquidity without interfering with the long-term growth of your policy, provided that the financing and rate of interest are managed carefully.

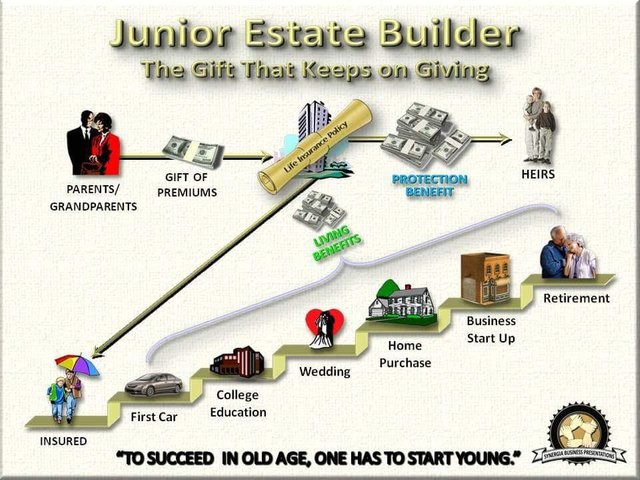

The process continues with future generations. As grandchildren are birthed and grow up, the ILIT can buy life insurance policy policies on their lives too. The trust fund after that builds up multiple policies, each with expanding cash values and survivor benefit. With these plans in place, the ILIT properly ends up being a "Family Financial institution." Member of the family can take lendings from the ILIT, utilizing the cash money worth of the plans to money investments, start companies, or cover major costs.

A critical facet of managing this Family members Financial institution is making use of the HEMS criterion, which stands for "Wellness, Education And Learning, Maintenance, or Assistance." This guideline is often consisted of in count on contracts to guide the trustee on just how they can disperse funds to recipients. By sticking to the HEMS standard, the depend on guarantees that circulations are made for crucial demands and long-lasting support, securing the trust fund's possessions while still providing for member of the family.

Enhanced Flexibility: Unlike stiff small business loan, you regulate the repayment terms when obtaining from your own plan. This permits you to structure repayments in a method that lines up with your business capital. family banking strategy. Enhanced Cash Money Circulation: By funding overhead through policy fundings, you can potentially release up money that would certainly otherwise be bound in traditional lending payments or equipment leases

He has the exact same devices, but has also constructed extra cash money value in his plan and got tax benefits. And also, he now has $50,000 offered in his plan to use for future possibilities or costs., it's important to see it as even more than just life insurance coverage.

Banking Life Insurance

It's concerning developing a flexible funding system that provides you control and provides numerous advantages. When utilized strategically, it can match various other financial investments and service approaches. If you're interested by the capacity of the Infinite Banking Idea for your service, below are some steps to take into consideration: Enlighten Yourself: Dive deeper right into the principle through reliable books, workshops, or examinations with experienced professionals.

Latest Posts

Generation Bank: Front Page

Infinite Banking Services Usa

Is Infinite Banking A Scam