All Categories

Featured

Table of Contents

The are whole life insurance coverage and universal life insurance policy. The cash worth is not added to the fatality benefit.

The policy car loan interest price is 6%. Going this course, the passion he pays goes back right into his plan's cash money worth instead of a financial establishment.

How To Have Your Own Bank

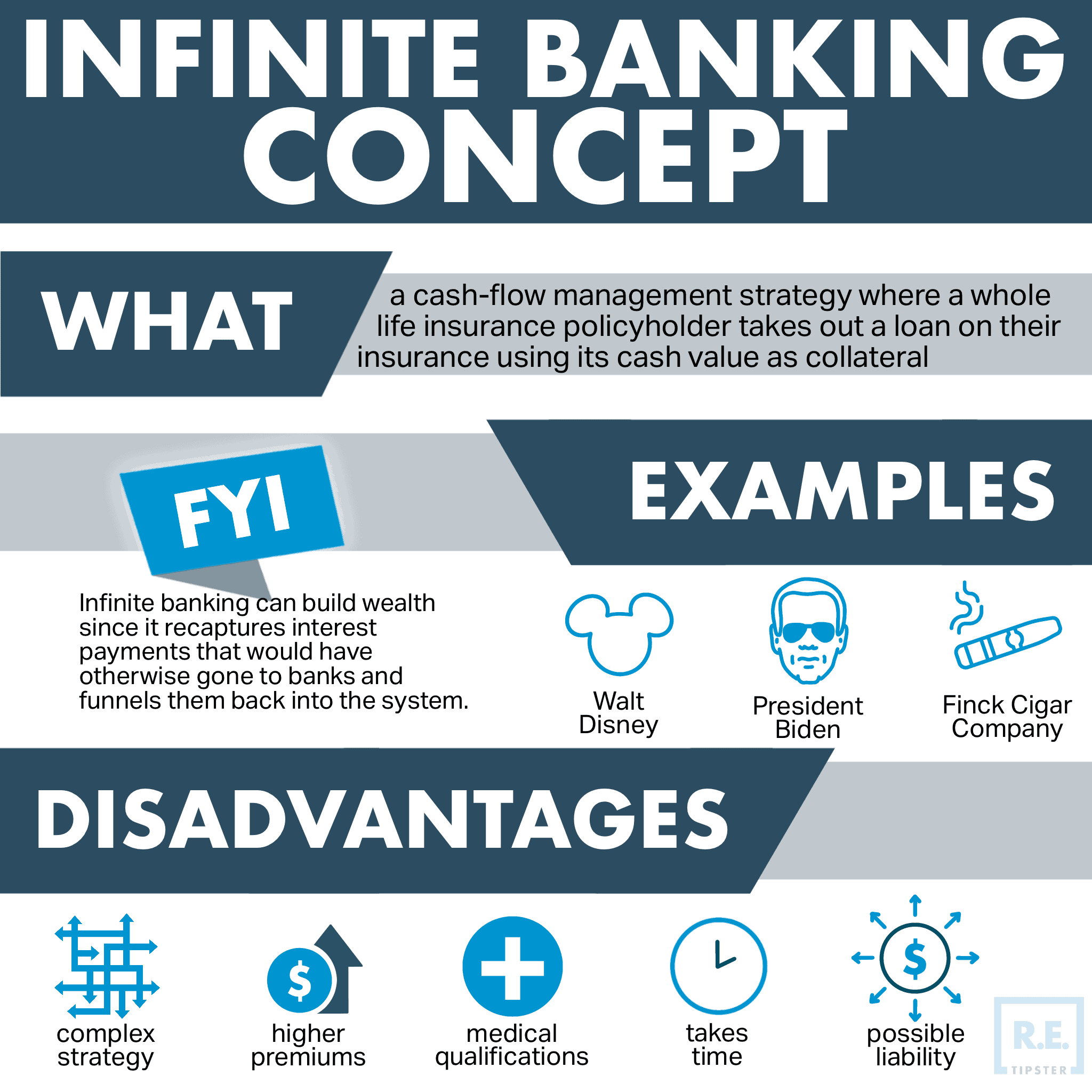

The principle of Infinite Banking was developed by Nelson Nash in the 1980s. Nash was a financing professional and follower of the Austrian institution of economics, which supports that the worth of goods aren't clearly the result of conventional economic structures like supply and demand. Instead, people value money and products in a different way based on their financial standing and needs.

One of the pitfalls of typical financial, according to Nash, was high-interest rates on car loans. Way too many individuals, himself consisted of, obtained into economic problem due to reliance on financial organizations. So long as financial institutions established the rate of interest and loan terms, people didn't have control over their very own riches. Becoming your own banker, Nash determined, would place you in control over your monetary future.

Infinite Banking requires you to have your monetary future. For goal-oriented people, it can be the finest financial device ever. Here are the benefits of Infinite Banking: Probably the solitary most valuable facet of Infinite Financial is that it improves your money flow.

Dividend-paying whole life insurance policy is very reduced danger and offers you, the insurance holder, a good deal of control. The control that Infinite Banking supplies can best be grouped into two categories: tax advantages and asset defenses - infinite banking nash. One of the reasons entire life insurance coverage is perfect for Infinite Financial is exactly how it's tired.

Priority Banking Visa Infinite Credit Card

When you make use of entire life insurance coverage for Infinite Financial, you participate in a private agreement in between you and your insurance provider. This personal privacy uses certain possession defenses not located in other financial vehicles. Although these protections may vary from one state to another, they can include protection from asset searches and seizures, security from judgements and protection from lenders.

Entire life insurance policies are non-correlated possessions. This is why they work so well as the monetary foundation of Infinite Financial. No matter of what takes place in the market (supply, real estate, or otherwise), your insurance policy maintains its well worth.

Entire life insurance coverage is that third container. Not just is the price of return on your entire life insurance coverage plan ensured, your fatality benefit and premiums are additionally ensured.

This framework aligns flawlessly with the principles of the Continuous Riches Strategy. Infinite Banking attract those seeking greater financial control. Right here are its major benefits: Liquidity and accessibility: Policy financings provide instant access to funds without the constraints of standard bank loans. Tax effectiveness: The money value grows tax-deferred, and plan loans are tax-free, making it a tax-efficient tool for building wide range.

Infinite Banking Concept Example

Property protection: In numerous states, the money worth of life insurance coverage is secured from financial institutions, including an extra layer of economic safety. While Infinite Financial has its benefits, it isn't a one-size-fits-all remedy, and it features substantial drawbacks. Here's why it may not be the very best method: Infinite Financial usually needs elaborate plan structuring, which can perplex insurance policy holders.

Visualize never ever having to stress regarding financial institution loans or high rate of interest prices again. That's the power of infinite financial life insurance.

There's no set finance term, and you have the flexibility to pick the settlement timetable, which can be as leisurely as paying off the loan at the time of fatality. This versatility encompasses the servicing of the fundings, where you can decide for interest-only settlements, keeping the car loan balance flat and convenient.

Holding money in an IUL fixed account being attributed rate of interest can commonly be far better than holding the cash money on deposit at a bank.: You've constantly desired for opening your own bakeshop. You can obtain from your IUL policy to cover the initial expenses of leasing an area, buying equipment, and employing staff.

R Nelson Nash Infinite Banking Concept

Individual loans can be obtained from standard financial institutions and credit scores unions. Here are some bottom lines to think about. Credit rating cards can give a versatile way to obtain money for really short-term durations. Obtaining cash on a credit report card is typically very pricey with yearly percentage prices of rate of interest (APR) frequently getting to 20% to 30% or more a year.

The tax obligation therapy of plan financings can vary dramatically depending upon your nation of residence and the specific terms of your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy fundings are typically tax-free, offering a considerable benefit. In other territories, there might be tax implications to think about, such as potential tax obligations on the finance.

Term life insurance policy just gives a survivor benefit, with no cash money worth buildup. This indicates there's no cash money worth to obtain versus. This post is authored by Carlton Crabbe, Chief Executive Policeman of Funding permanently, a professional in offering indexed universal life insurance coverage accounts. The details given in this short article is for academic and educational functions just and should not be taken as economic or financial investment recommendations.

For loan policemans, the extensive regulations imposed by the CFPB can be seen as cumbersome and limiting. First, lending officers commonly suggest that the CFPB's guidelines develop unnecessary red tape, causing more documentation and slower car loan processing. Policies like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) requirements, while intended at securing customers, can cause hold-ups in closing offers and increased operational expenses.

Latest Posts

Generation Bank: Front Page

Infinite Banking Services Usa

Is Infinite Banking A Scam